Global supply chain update - October 2021: Tips to avoid disruption

Ali once said “the fight is won or lost far away from the witnesses, behind the lines, in the gym and out there in the park, long before I dance under the lights”.

The aim of this supply chain report is simple. Prepare your business for the conditions ahead with the data you require to make informed decisions.

The first challenge: Expect delays as supply chains bottleneck

You don't need to look too far to see the impact the pandemic had wreaked on the movement of goods and services both locally and internationally over the last 18 months. Whether it's parts for your car, vaccines, a new phone screen, or your favorite treat, every industry is feeling the strain.

Today, the Delta variant has exacerbated the woes of supply chains further, prompting many nations in Asia to cut off land access for sailors. Given that ships transport around 90% of the world's trade, the crew crisis is another factor disrupting the supply of everything and driving up costs.

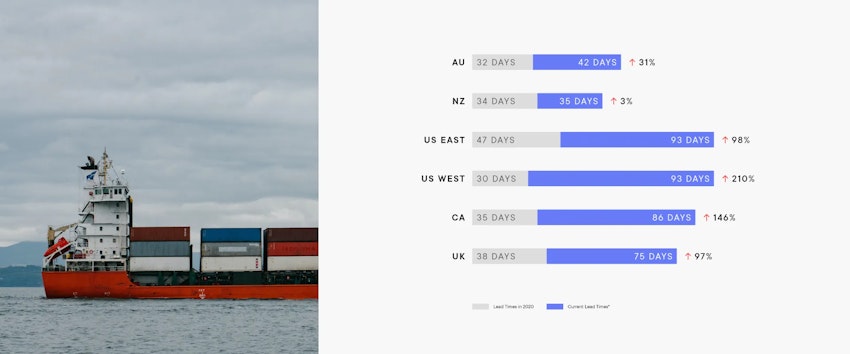

Unfortunately, we too are not immune to the current challenges. As a number of raw materials are sourced from around the world and manufactured in another, we're seeing the impact of this delay in the delivery of orders (see table 1).

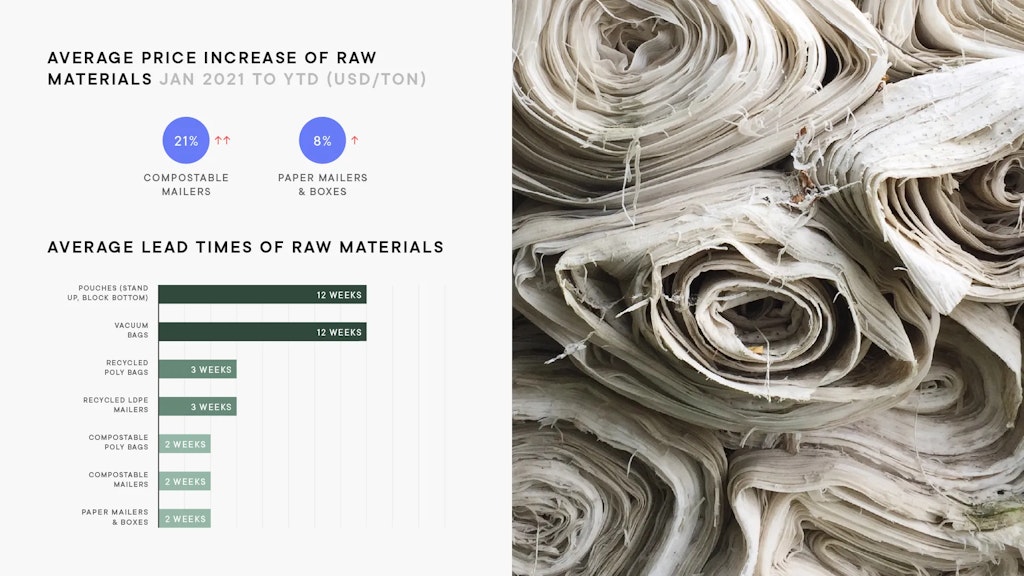

The aforementioned conditions have also impacted pricing with the costs of raw materials increasing by 15% since the beginning of the year.

Average sea-freight delivery timeframes

Average air-freight delivery timeframes

Although flight time between airports can take up to 1-2 days, the expected lead time between production being completed to being delivered can be up to 20 days, depending on the destination.

Market updates in air and sea-freight

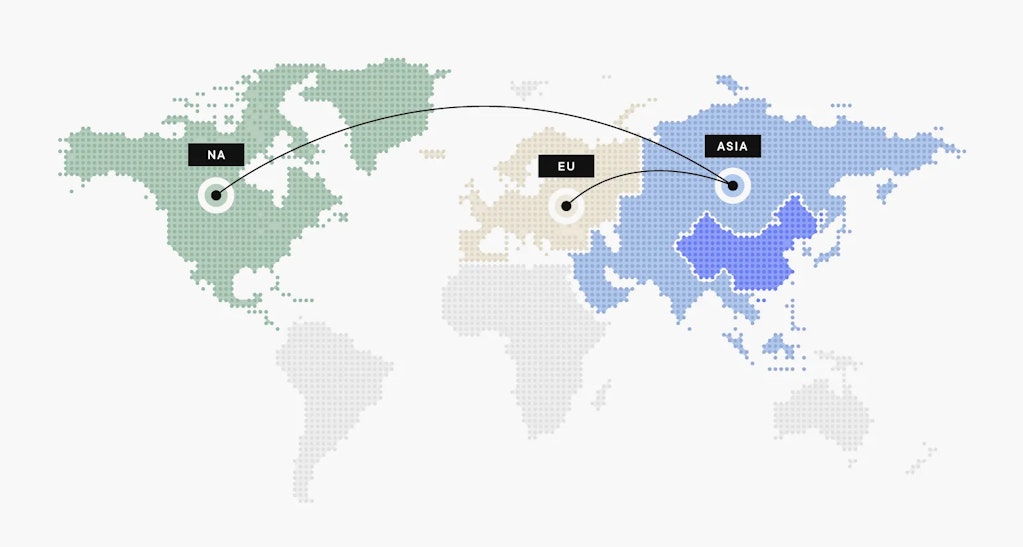

Asia → North America

TPEB congestion surcharges and changing freight rates are expected due to high levels of demand as we head into peak season. Spikes in imports from Asia are expected to remain at high levels well into December.

Asia → Europe

Market demand exceeds supply and is exacerbated by blank sailings and poor equipment availability. Schedule reliability is low.

China

China is facing a new COVID outbreak. It's reported that this outbreak has spread to 8 provinces, leading to increased testing and port delays.

On the 12th of September weekend, Typhoon Chanthu hit off the east coast of China, affecting the Zhejiang area close to Ningbo and Shanghai. While the Ningbo terminals and warehouses have now resumed operations (after closures and an 18-day lockdown prior), delays on supply chains are ongoing.

Asia - Asia Pacific

Ports continue to face limited space and equipment in Asia. Golden Week in October will lead to reduced capacity while carriers are announcing blank sailings. Schedule reliability across ANZ remains low. Costs and delays are expected to worsen across AU due to ongoing industrial action by the Maritime Union of Australia (MUA) and temporary closures due to workers testing positive to coronavirus.

Latest market updates in air freight

Airports are still being affected by COVID-19 cases and thus operating at reduced capacity. Overall congestion in logistics and new waves of the virus will lead to an increase in the number of bookings for air freight in order to meet delivery timeframes. Due to this reason, it is expected that the prices will continue to increase and availability for bookings will be limited.

The constraints with raw materials

The challenges facing the shipping industry are also affecting our supplier's lead times, pricing, and availability of raw materials.

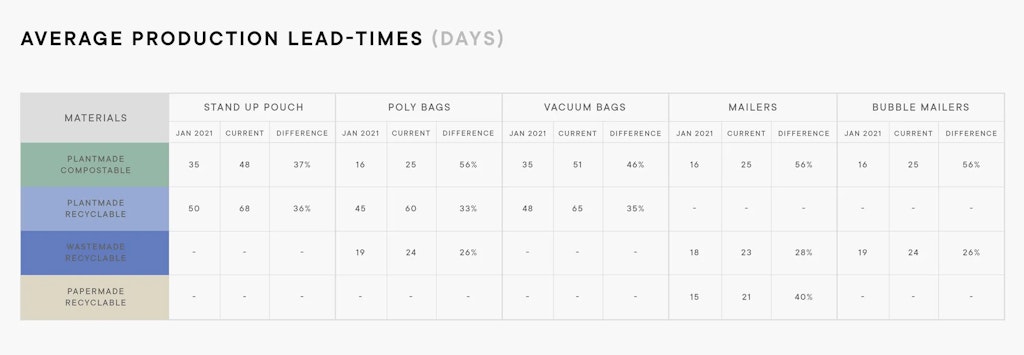

Production timeframes

As you can imagine, the supply chain challenges are also presenting a few headaches for our team.

This is primarily impacted by:

- The delayed arrival of raw materials and machine parts

- The backlog of orders caused by these delays

- Peak-electricity restrictions at some of our manufacturing plants.

Electricity restrictions

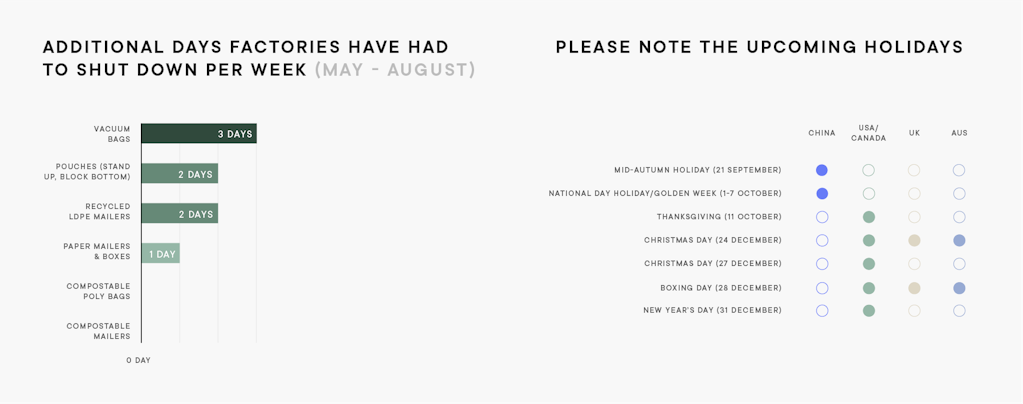

More than a dozen provinces in China, including Guangdong Province, the largest manufacturing hub in the world, are facing electricity shortages during the summer months; Local governments have ordered factories to restrict their electricity consumption up to 1-2 days per week.

The power crunch has contributed to a slowdown in factory activity growth in China in June (according to the country's National Bureau of Statistics) and has partly contributed to longer production lead times outlined above.

These restrictions are expected to continue throughout October and into December.

Our tips to avoid disruption for the next 6-12 months

Get ahead

Factor in an additional 1-2 months lead time on your orders to avoid the impact of further delays & rising costs.

Explore

Prioritize new risks and implications to your supply chain services and ecosystem. This might include holding additional safety stock you can draw from should you experience any unforeseen delays.

Scenario planning

Identify “what if” scenarios & develop protocols for each. The question to keep asking the team – what measures are in place to overcome the scenarios identified? Planning should cover; sourcing, production, distribution and service implications. Build freight delays into your planning and diversify your carrier options to cater for unexpected events.

Customers

We believe good customer service really gets to shine in times of adversity. By keeping your audience informed - even if it's not the news they want to hear, allows them to not only plan ahead but it also builds trust.

For our customers

Preparation

The majority of orders are moving in the right direction but we do recommend having a contingency plan in place and confirming order requirements early.

Contact us.

For those who have further questions please feel free to reach out to your Account Manager. Our team is in daily contact with our partners right across the supply chain to monitor movements and mitigate risks by stocking up.

Thank you for your support as we work towards a successful end of the year and continue to pave the path in our supply chain to deliver solutions that are good for you and the planet.